Hobbs’ new headache

The Big Beautiful Tax trap … The new Raul … And not another Sham(p) candidate.

Gov. Katie Hobbs has a big decision to make next year.

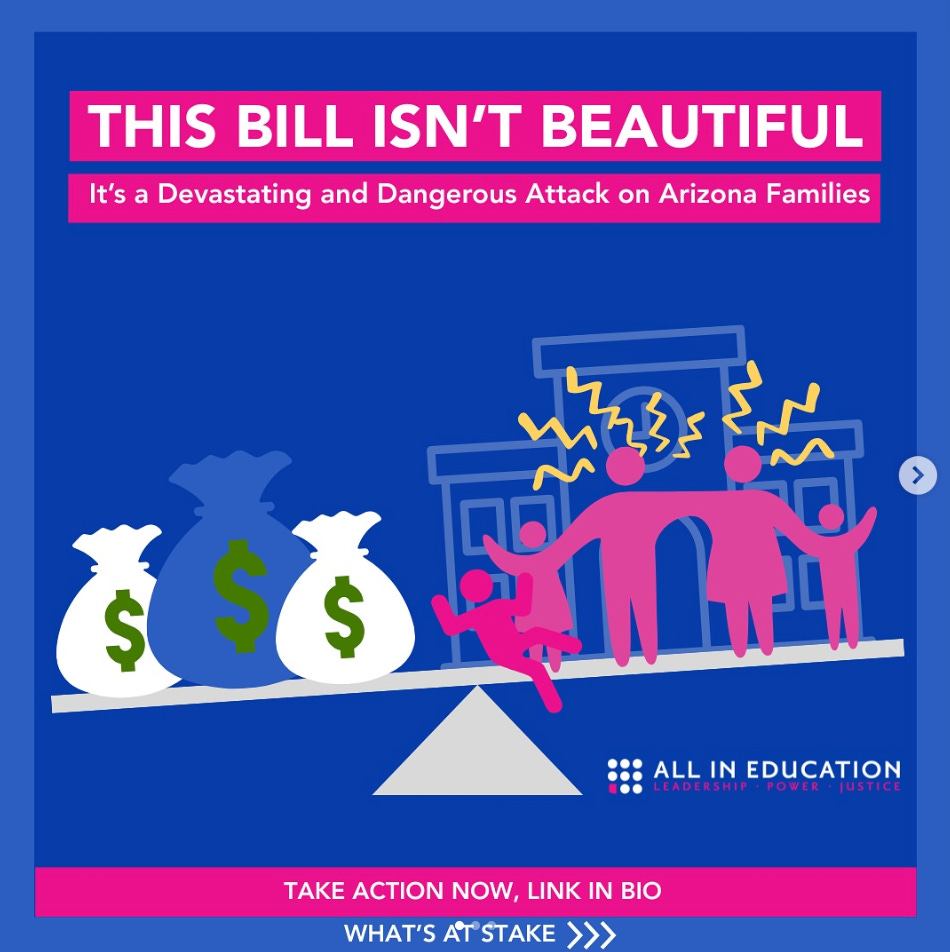

Congress just passed an array of tax cuts in President Donald Trump’s “Big Beautiful Bill” that will eat into Arizona’s finances.

The bill slashes Medicaid and food assistance benefits to help pay for $4.5 trillion worth of tax cuts over the next decade, and most of the tax breaks will show up on 2025 tax filings.

Next year, Arizona’s Legislature and governor have to decide if the state will also adopt a variety of tax changes on things like reducing taxes on tips and overtime.

The Joint Legislative Budget Committee, a group of economic intellectuals who advise lawmakers on the state’s finances, estimates Arizona will lose $381 million by conforming to the federal bill’s tax cuts this fiscal year.

That’s just a drop in the bucket of all the federal funding cuts coming Arizona’s way. But it could be the first time we see Hobbs and lawmakers take an actionable stance against the Big Beautiful Bill.

One of the first bills the governor signs every year is a “tax conformity” measure that aligns the state’s tax rules with the federal government’s so it’s easier for people to file both types of returns.

Not conforming would create a bureaucratic tax nightmare. But the federal tax cuts are funded by slashing public service programs, which Democrats and Hobbs are adamantly against.

Hobbs signed a bill conforming the taxes Arizonans had to pay on their 2024 incomes to the federal rules on Feb. 28. It’s usually a procedural task.

But in 2019, Arizona passed a tax conformity bill adopting federal tax measures a year after they took effect in 2017. There was a political showdown over where to put the extra money.

There was also widespread uncertainty about when tax returns would come in, and accountants urged the Legislature to figure it out.

The 2026 legislative session could see a similar political showdown over the politics behind the tax cuts. Plus, some of the cuts are pretty popular, including:

Letting taxpayers deduct the extra money they receive for working overtime, which the JLBC estimates will cost Arizona $76.5 million this fiscal year.

Allowing workers who earn tips to deduct up to $25,000 of those tips from their taxable income, at a $23.6 million hit to the state.

Giving people ages 65 and older a $6,000 deduction on their taxes, which would cost Arizona $53.7 million.

If Arizona does conform, that $380 million hit is only about 2% of the state budget. But it would put Arizona in the red for the year, considering the FY2026 budget only has a cushion of about $200 million in cash balance.

Republican Sen. John Kavanagh, who led the state’s budget this year, said $380 million from tax cuts amounts to a “rounding error” in a $17.6 billion budget. And worst case scenario, lawmakers could delay some projects they have already funded. In 2023, lawmakers cut hundreds of millions of dollars from new road projects to make up for a $2 billion anticipated budget shortfall over two years.

But if Democrats take a political stance against conforming to the new tax code, “then we will put a disclaimer on the bottom of every state income tax form which states, ‘The additional taxes you’re paying and paperwork hassles you are experiencing have been brought to you by the Arizona Democratic Party,’” Kavanagh said.

Trump's budget also makes huge cuts to social safety net programs like Medicaid and Supplemental Nutrition Assistance Program (SNAP) food benefits.

That means billions — with a b — in cuts to either make up the funding shortfall or outright cut social services.

The JLBC is still analyzing the massive bill to figure out what the state stands to lose from cuts to Medicaid and SNAP.

In the meantime, lawmakers don’t seem to be working on a backup plan.

Senate President Warren Petersen told us there are no plans for a special session, but didn’t answer further questions about what the plan is for addressing the multitude of revenue hits the state now has to weather. Either Hobbs or two-thirds of lawmakers can call a special session to meet after lawmakers adjourn for the year.

Hobbs’ spokesperson, Christian Slater, said the governor doesn’t have plans to call a special session yet, but “The administration is going through every provision with a fine-toothed comb to understand the full implications of this legislation and how to best protect Arizonans.”

And the Big Beautiful bill will have cascading, long-term effects on Arizona.

The various components of the federal bill have staggered effective dates. Most of the tax cuts start this tax year for the filings Arizonans will submit next spring, for example, while lowering provider taxes and subsequently reducing Medicaid starts in 2028.

Gov. Katie Hobbs already said Arizona doesn’t have enough money to cover the difference of federal cuts.

While the JLBC is still crunching the official numbers on total cuts, estimates say AHCCCS, the state Medicaid system, will lose $35 billion in federal funding throughout the next decade. Arizona will have to start covering 10% of SNAP benefit costs in fiscal year 2028, which could cost hundreds of millions.

It will take more than the state’s nearly $1.6 billion rainy day fund to cover all of those cuts on top of the $17.6 billion budget the state just passed.

The governor sent a letter to the state’s Congressional delegation asking them to reject the bill the same day she signed Arizona’s budget into law.

"As elected officials, we are called to put the best interests of the people we represent over politics. Now is a time to do just that and reject this dangerous legislation,” Hobbs wrote.

That "dangerous legislation" was signed into law, setting up a major tax policy battle at the state Capitol in 2026, and a much longer-term discussion about how much of the tab Arizona can and wants to pick up for programs like Medicaid and SNAP.

Nepo, newbie or no chance: All eyes are on the special election in Congressional District 7, and not just in the Southern Arizona district.