During an uncharacteristically gloomy afternoon at the Arizona Capitol this week, House Speaker Steve Montenegro battled gusts of wind that sent his notes flapping across the podium as he laid out Republicans’ latest position in the political battle over Donald Trump’s tax cuts.

“No Arizonan should be forced to amend a tax return because of shifting executive positions,” he said.

Montenegro, flanked by about 20 other legislative Republicans, announced the House and Senate GOP caucuses sent Gov. Katie Hobbs a letter warning that “any outcome that forces Arizonans to refile their taxes is a non-starter.”

It was a fittingly dramatic backdrop for what has become an unusually dramatic fight over something that is typically anything but: adopting Arizona’s tax code.

Republicans solemnly mourn the death of their tax negotiations with Gov. Katie Hobbs during Wednesday’s press conference.

So far, Hobbs has vetoed two Republican plans outlining how the state should conform to Trump’s tax cuts. She insists lawmakers instead pass the narrower, slightly less Trump-aligned package she rolled out in November under the banner of her “Middle Class Tax Cuts.”

Republicans, meanwhile, have repeatedly pointed to what they’ve framed as an unthinkable administrative failure: The Arizona Department of Revenue has already issued tax forms assuming federal tax conformity, so any deviation could force taxpayers who’ve already filed to amend their returns.

Every year, ADOR issues tax forms assuming the Legislature will match federal tax changes — because it usually does.

This year is not so typical: H.R.1, or Trump’s “Big Beautiful Bill,” rewrote major parts of the federal tax code that states like Arizona use as the foundation for their own systems. H.R.1’s changes cut into state revenue streams while shifting more public service costs onto state governments.

Add in an election year, and the fight isn’t just about tax policy. It’s about who voters hold responsible for the fallout.

Republicans want to make sure it’s not them.

After previously warning Arizona taxpayers to hold off on filing their state tax returns until politicians sorted out the tax code, Republicans issued new guidance Wednesday telling taxpayers to go ahead and file — and promised they’d make sure nothing changes.

“We have to create as much clarity as we can in this chaos, and so we are drawing a hard line,” said Republican Sen. J.D. Mesnard, who has led the GOP’s tax conformity effort. “We are not going to be the folks that require amended returns … that will not come from the Legislature. If the other side wants to try to own that issue, be my guest.”

The Executive Tower — headquarters of the “other side” — stands directly across the House and Senate on the Capitol plaza. But despite the short walk, neither Republican lawmakers nor the governor’s staff seems to have made the trip to negotiate in person.

Instead, the Governor’s Office and legislative Republicans have blamed one another for failing to negotiate. They’ve conducted the tax code fight through press releases, dramatic press conferences and veto letters.

And with taxes due in less than two months, tax preparers are desperate for some clarity.

The letter House and Senate Republicans sent Gov. Katie Hobbs on Wednesday — the GOP’s’ Declaration of Tax Independence — contains four pages of signatures.

Now, the standoff has landed on the outcome worst for Hobbs, and the most punishing for the state’s bottom line: full adoption of the Trump tax cuts.

It’s now a question of who blinks first.

Hobbs could still back down and adopt the full H.R.1 tax package, even after painting herself into a corner by blasting the extra corporate tax cuts baked into it. Or she could stick to her position, but that would force some who already filed to amend their tax returns.

Republicans have now drawn their own hard line, saying they’ll only pass a tax code with the business tax cuts — but if that doesn't happen in the next few weeks, taxpayers will reach the April 15 deadline filing returns that technically don’t comply with state law.

That scenario would be uncharted territory, even for Kevin McCarthy, the longtime Arizona Tax Research Association president who’s been with the group since 1986.

“What I expect is going to happen now is nothing,” he told us. “I think we're going to go through the April 15 filing deadline with nothing being done on this, and people are going to be filing on forms that certainly aren't grounded in any Arizona law.”

In addition to opposing what they’ve framed as corporate tax cuts, Democrats have repeatedly emphasized the need to know what programs Republicans plan to cut before agreeing to a new tax code.

Last year, during a similarly communication-starved budget standoff that nearly shut down state government, Hobbs secured funding for several priorities that require ongoing money, such as child care, public university scholarships and new school construction.

It would look really bad for her reelection bid if those programs were lost to Trump’s tax cuts.

At Wednesday’s press conference, Montenegro said Arizona has “sufficient cash balances to cover the impact this year” without making major cuts.

Still, Democrats argue tax changes belong in broader budget talks, pointing to the 2019 fight under Republican Gov. Doug Ducey, when the state tax code was folded into end-of-session negotiations.

The difference then, McCarthy explained, was that Arizona’s tax forms were already largely consistent with state law, because lawmakers had adopted most federal tax changes the year before.

“This situation is profoundly different, in that we've obviously not conformed for the 2025 tax code,” he said.

How did we get here?

The Legislature’s tax standoff has been brewing since last year.

Republicans asked Hobbs to call a special session in November after she announced her tax plan. She declined.

The governor promoted her tax proposal in her State of the State address and urged lawmakers to send it to her desk.

Instead, Republicans advanced their own conformity plan that adopted some provisions of H.R.1 — including the corporate tax changes — while omitting others.

Knowing the governor’s veto was coming, Republicans held a dramatic press conference where Montenegro spoke directly to the governor, who wasn’t there.

“Madam governor, you have a choice to make,” he said. “Sign the bill and support families and give taxpayers certainty to file, or you can veto the bill and prepare for the chaos that you're creating.”

In her veto letter of that initial GOP tax plan, Hobbs said Republicans were holding taxpayers “hostage” to “force through tax breaks for special interests.” The GOP proposal carried a $441 million revenue hit this fiscal year — $147 million of it tied to business tax breaks.

Republicans then sent Hobbs a plan for full adoption of the Trump tax changes. She vetoed it with a firm tone:

“My position on tax conformity remains clear: Send me the Middle Class Tax Cuts Package,” Hobbs wrote in her veto letter.

But behind the scenes, there were mixed signals.

After the first veto in January, Montenegro and Petersen sent Hobbs a letter asking for guidance, noting the tax forms already in circulation didn’t match her preferred plan, and some taxpayers who had already filed could be forced to amend their returns.

Eleven days later, Hobbs’ budget director, Ben Henderson, responded.

“We are not opposed to full conformity,” he wrote. “But the Governor has been clear that she will not do so by sacrificing critical programs and services that millions of struggling Arizonans rely on.”

Instead, the administration proposed passing the individual income tax pieces now and negotiating the business tax cuts later as part of budget talks.

Which is where things get circular: Full conformity — the very concept Henderson said the governor isn’t opposed to — would, by definition, include those same business tax cuts.

Ultimately, any tax plan that removes the business tax provisions already built into Arizona’s current filing forms would likely force some filers to amend their returns.

And the political optics go beyond bureaucratic hassle — some taxpayers could end up owing the state more money.

For now, both sides are dug in. Hobbs refuses to sign off without clarity on how Republicans would protect her priorities while giving up hundreds of millions in state revenues. Republicans are stuck on full adoption of the federal tax cuts.

We’ll see who makes the trip across the Capitol plaza first.

Musical chairs: Republican Rep. Joseph Chaplik announced on Twitter that he is going to resign from the Legislature next week so he can run in Congressional District 1, adding another twist to the CD1 race and opening a seat at the Capitol for some lucky(?) Republican from Scottsdale. U.S. Rep. David Schweikert represents CD1, but he’s running for Arizona governor. Gina Swoboda, until recently the chair of AZGOP, was running in CD1, but she dropped out last week to run for Arizona secretary of state.

Mental disconnect: Two Surprise women who voted for President Donald Trump because of his mass deportation agenda aren’t happy that the warehouse next to the cheerleading gym they run is going to be converted into an immigration detention center, the New York Times reports. Some of their students are little kids who might see “people in shackles” next door, which is a “scary thing for a little kid to process.”

Smile! You’re already on camera: Arizonans in cities across the state are up in arms about Flock license plate readers, but federal immigration agencies already built a vast monitoring network of license plate readers in the state, the Arizona Mirror’s Jerod MacDonald-Evoy and the Border Chronicle’s Todd Miller report. The cameras are especially prevalent around the Tohono O’odham Nation in Southern Arizona, where residents say they’re under constant surveillance by the DEA.

“This feels very similar to the ways we had towns where Indigenous communities were not allowed to be out after sundown,” Dave Maas, the director of investigations for the Electronic Frontier Foundation, told the reporters. “This feels like a digitized version of that.”

Don’t whistle while they work: A Senate committee advanced a bill that would criminalize using social media to let people know ICE is in the neighborhood, the Arizona Mirror’s Gloria Rebecca Gomez reports. The bill creates a new crime of “unlawful alerting,” and while Republicans argue it’s only aimed at knowingly helping someone escape imminent arrest, critics argue it’s a blatantly unconstitutional attack on free speech, and Arizona already has laws to prosecute someone for helping someone escape arrest.

Help us alert you to new bills — while it’s still legal — by becoming a paid subscriber today.

Call it the Don Lemon law: Disturbing worship services would be a misdemeanor under HB4117 from Republican Rep. Teresa Martinez, KJZZ’s Kathy Ritchie reports. And at least one Democrat is on board. Rep. Alma Hernandez said “none of us want to be disturbed when we’re at a religious service.”

In other, other news

State officials are going to cull the Salt River horse herd for the first time since a state law was passed to protect the horses (Zach Buchanan / New Times) … A controversial aluminum melting plant in Benson got its final permit from the state (Andrew Christiansen / KGUN) … School district superintendents would face felony charges if they don’t tell parents about any safety threats under HB4109 (Alexandra Hardle / Republic) … And a bill that would have required officials to tell Arizonans about the worst-case scenario for the Colorado River failed in committee amid pressure from water providers (Jerod MacDonald-Evoy / Arizona Mirror).

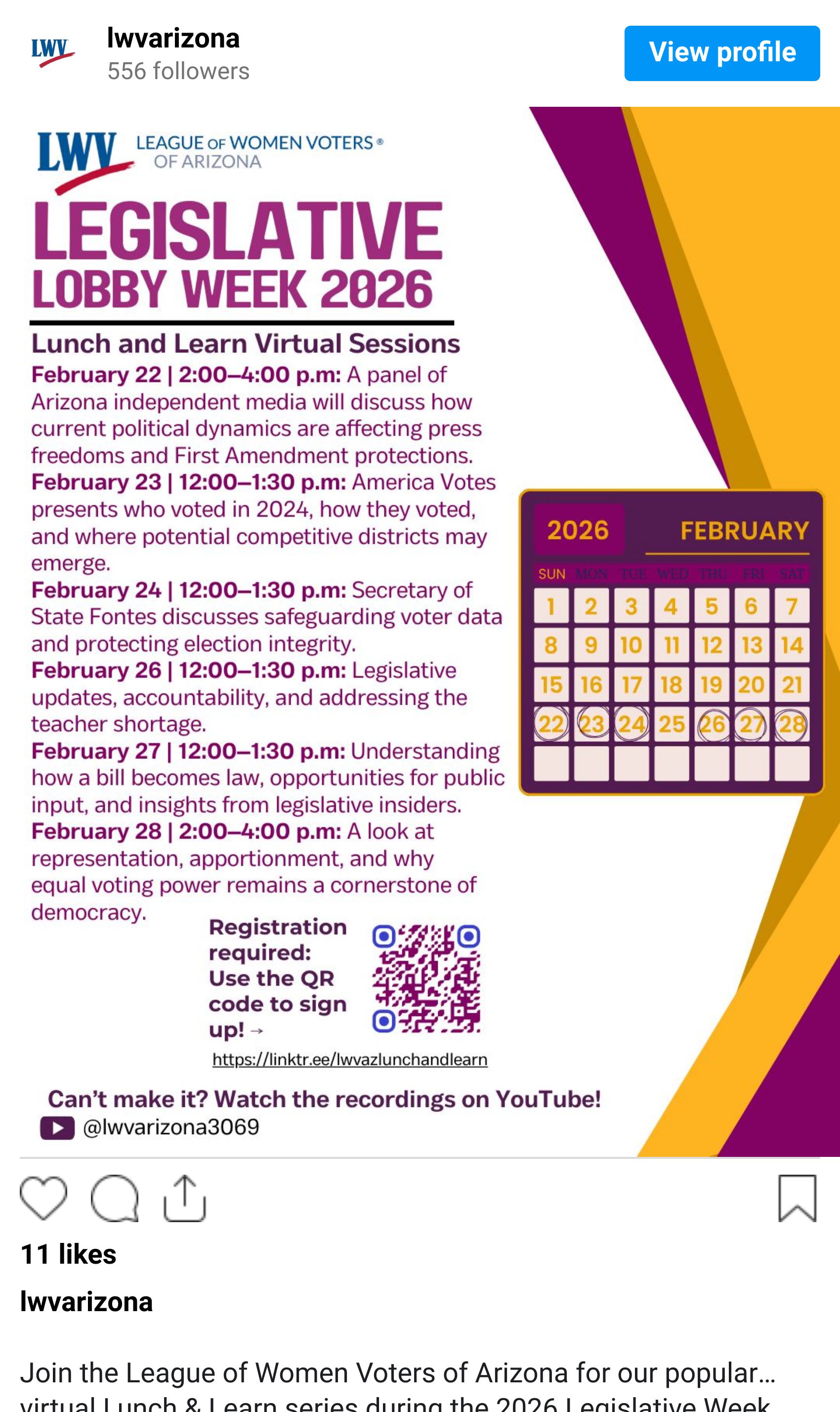

Nicole accidentally scheduled herself for a full weekend of talking politics and the media. Here are her public sightings:

Saturday, Feb 21 @ 10 a.m. (Registration required)

Sunday, Feb. 22 @ 2 p.m. (Virtual event)

Now, we know that we make fun of Republican Sen. Jake Hoffman a lot here at the Agenda.

And fair warning — today will be no different.

But first, here’s an impassioned speech he gave about his good friend Charlie Kirk. It was actually a quite heartwarming, tearful talk about the value of free speech and respecting those you disagree with.

It’s worth a watch, even if just to see a glimpse of Hoffman’s softer side.

We’re not making fun of that.

But…

Here’s the chaser.